I Earned 825K Credit Card Points Worth $18,000 in 2025

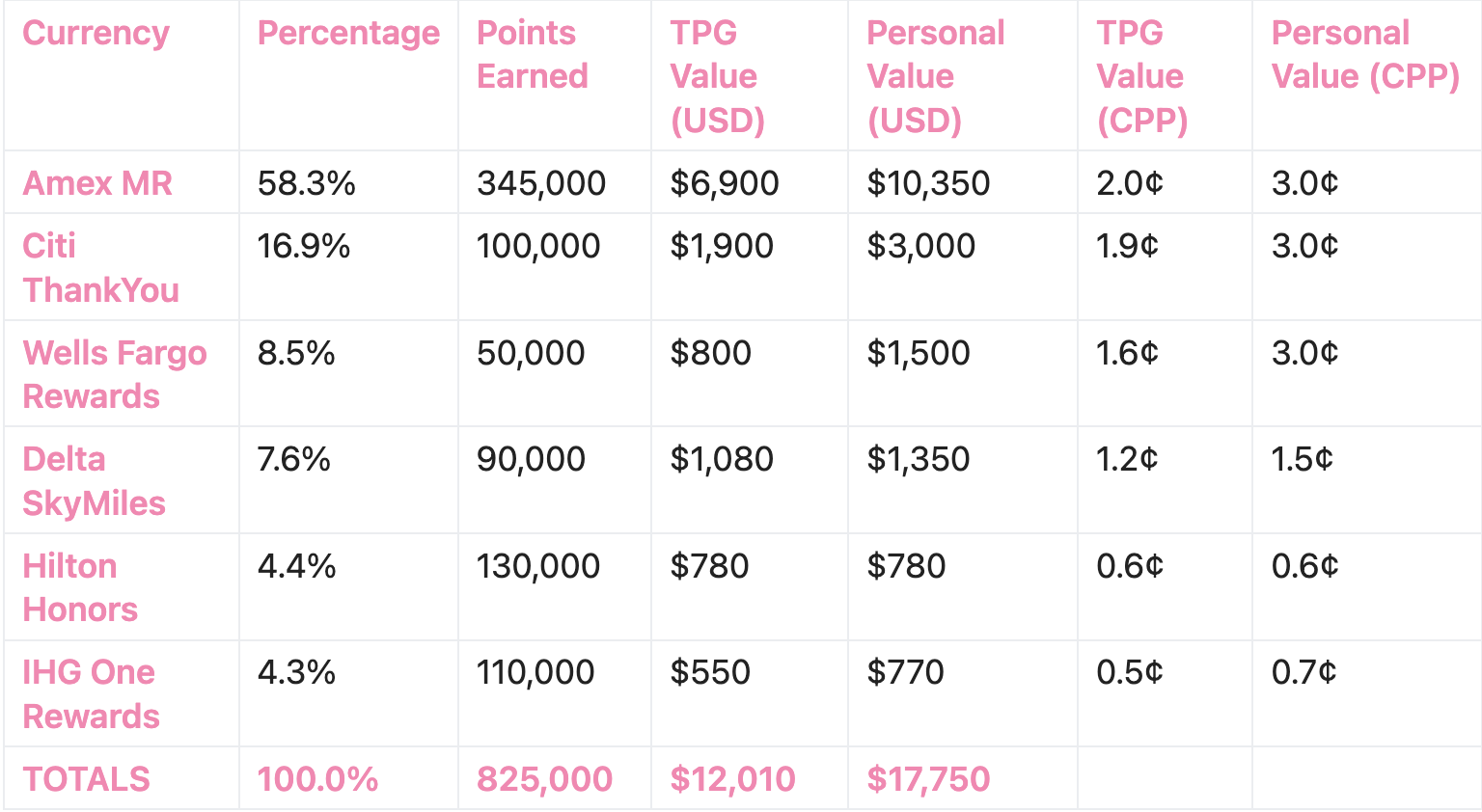

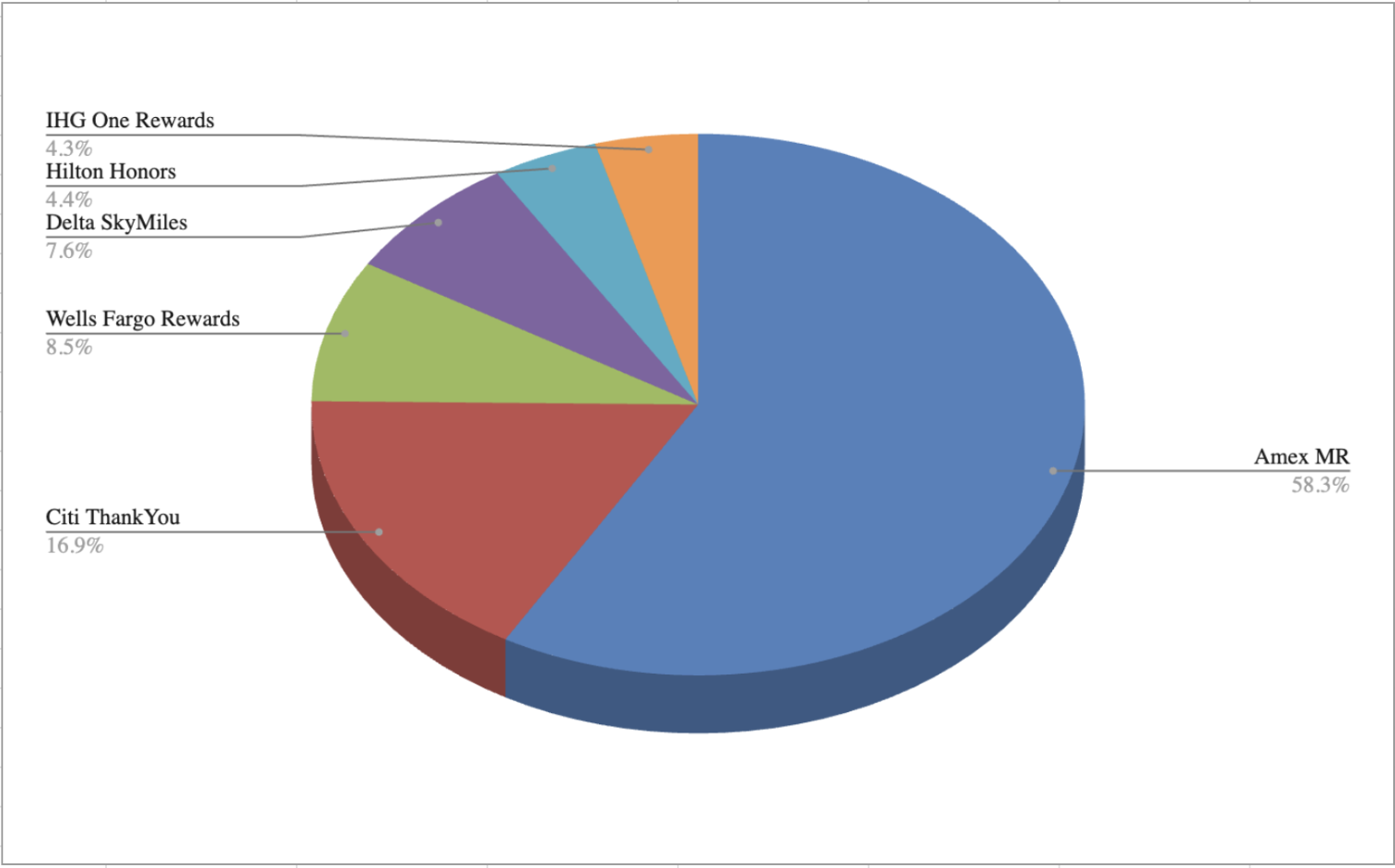

In 2025, I earned 825,000 credit card reward points across 6 different programs through a combination of spend and new card bonuses, worth approximately $18,000 in travel value.

Generally, I consider myself to be quite a frugal individual. The fact that I could accumulate such a colossal amount of points is a testament to the various easy points earning mechanisms that are out there.

With high bonus category multipliers and extremely generous sign-up-bonuses, American Express Membership Rewards points takes the top crown, quickly followed by Citi ThankYou and Wells Fargo Rewards points (see breakdown table above).

I prefer earning such transferable currency over hotel or airline specific ones, but between Delta, Hilton and IHG, I always welcome earning points in a program that I can regularly put to good use.

$18,000 in Estimated Travel Value

Everybody's travel habits demand a different point valuation.

For some people, American Express Membership Rewards (MR) points might provide 1.2 cents-per-point (used on AMEX Travel), while for others it might provide 3-4 cents-per-point (redeemed for business class flights through transfer partners).

There's no "one value to rule them all". Because of that, I have provided two different values - TPG's valuation and my personal valuation based on historical redemptions.

Using TPG - $12,000

Using Personal Redemptions - $18,000

The major difference is valuation of transferrable currencies (AMEX MR, Citi ThankYou, Wells Fargo Rewards). More often than not, I transfer them to Qatar Avios, Avianca LifeMiles and Flying Blue to redeem Qatar Airways, Turkish Airlines, Delta / Air France, respectively, easily getting more than 3 cents-per-point (CPP) for business class flights.

Hence, I value all transferable points at 3CPP. Your mileage may vary.

When it comes to Delta SkyMiles, I value them slightly higher (1.2 vs 1.5 CPP) because I hold the AMEX Delta Gold credit card that automatically gives me 15% off all domestic award flights. Even with Delta's dynamic pricing, in one of my most frequency routes (ATL - SFO), I easily get 1.5 CPPs.

Finally, hotel currencies - Hilton Honors and IHG Rewards. I usually take full advantage of 5th-night-free or 4th-night-free (respectively) benefits. Yet, I don't consistently get significantly more value that TPG.

Recap - across these 6 programs, I have accumulated a massive 825K points, worth $18K according to my valuation (and $12K by TPG's).

Notable Credit Cards

They key to earning points so quickly is having a strategic core credit card setup that earns you the highest number of points on your highest spend categories (dining, grocery, gas, etc).

Here are a few notable ones from my setup:

Closing Thoughts

All in all, 2025 was a great points-earning year. I have earned enough points to feed all my travels in 2026 and 2027.

Next I will create a strategy for some big targeted redemptions in 2028, starting with a new core wallet setup for 2026.

Recommended Cards

Free ConsultationSimilar Posts

June 1, 2025

$1,500 Hotel Nights for $0 in the North Georgia Mountains

New hotel strategy using American Express Gold and Hilton Surpass credit cards.

March 12, 2025

How I Earned 900K Credit Card Points in 2024 Worth $11,000

Discover how to turn your Starbucks spending into free flights across North America!

June 12, 2023

How I Travel the World for Free Using Credit Card Points

A simple 3-step process that earned me trips to Chicago, Boston, Atlanta, Dallas, San Francisco, and Toronto for free!

July 2, 2024

$3,712 of Free Travel in 2024 Using Credit Card Points

5 Cities. Business Class Flights. Free Hotel Nights.

December 10, 2023

Travel Hacking San Francisco

How I paid $0 instead of $2,543 with credit card points.

May 17, 2025

What's In My Wallet Q2'2025?

200K MR points, $400 cashback, 14K Capital One Miles shoping portal bonus and more!

February 26, 2025

Best Credit and Debit Card Setup for International Travel

Discover the best credit and debit cards for international travel with no foreign transaction fees and unlimited ATM fee rebates.