Best Credit Cards for AWS Expenses

If you’re running a software business, your single largest expense—outside of payroll—is likely your cloud bill. Whether you’re a solo founder or scaling to a mid-market leader, ignoring the "rebate" on that spend is a massive oversight.

Today, I want to talk about how to treat your Amazon Web Services or AWS bill as a revenue stream by choosing the right credit card and the specific travel routes these points unlock.

The Basics: Example Expenses

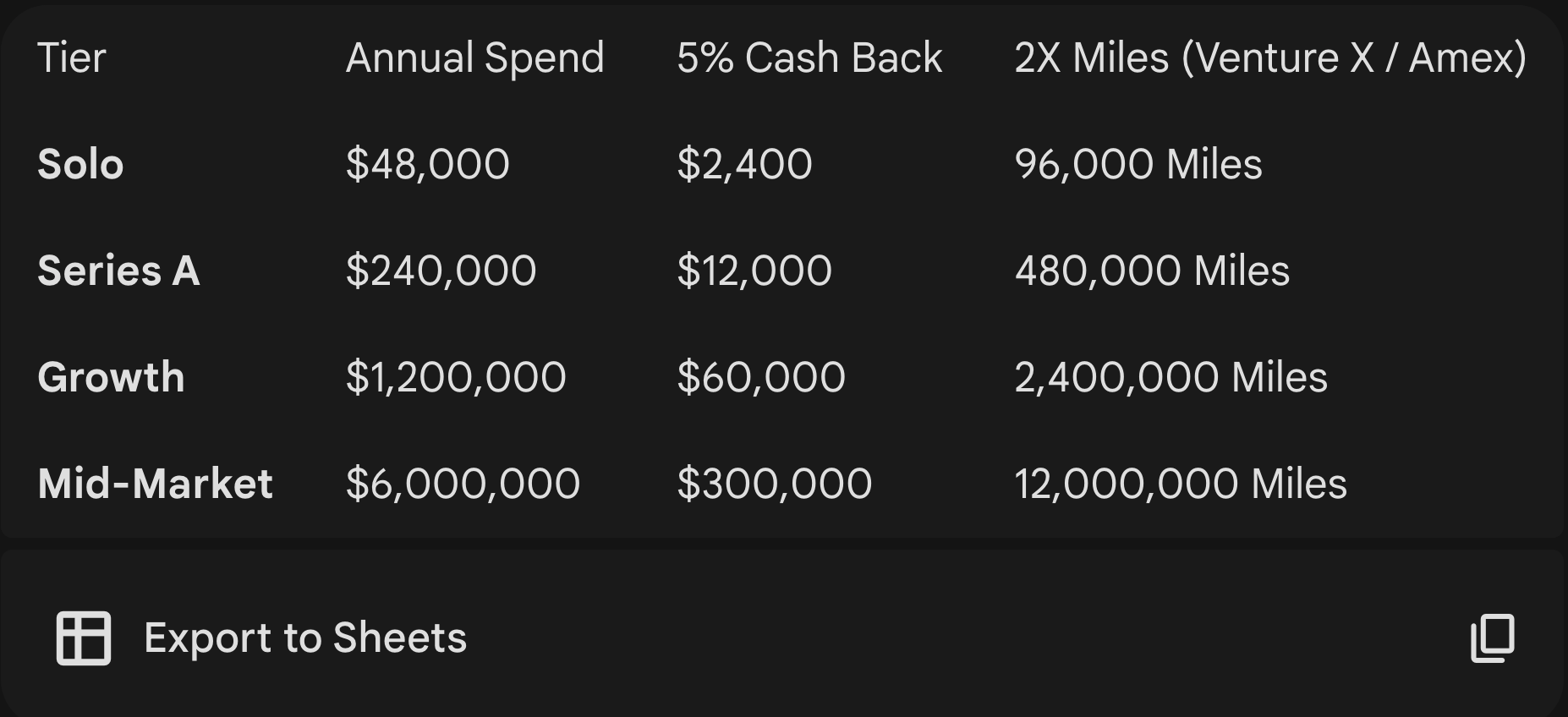

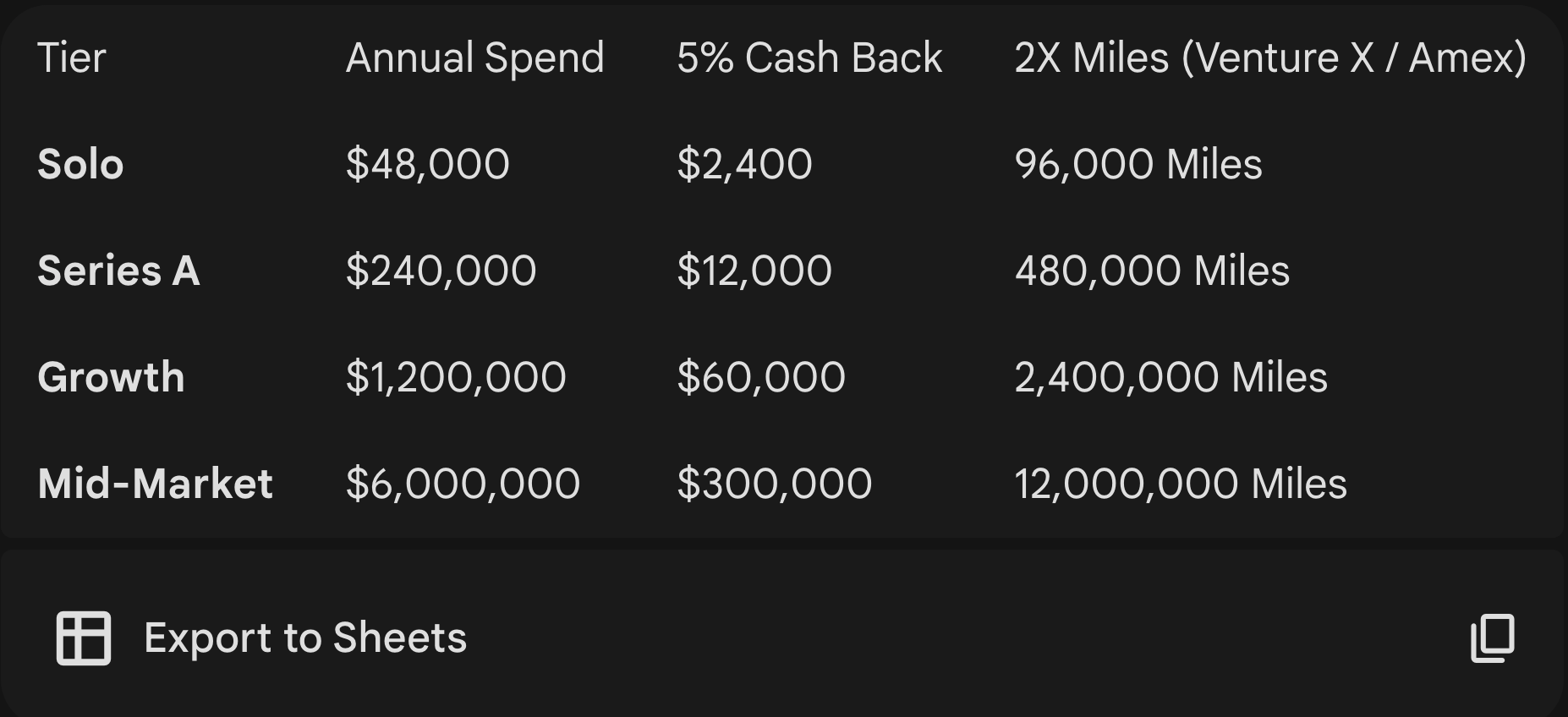

Cloud computing scales rapidly. Based on industry benchmarks and recent growth-stage data, here is what that looks like:

The Solo App: $4k/month ($48k/year). Typical for a side project or an early-stage SaaS.

The Series A Startup: $20k/month ($240k/year). Moving from prototype to production.

The Growth Stage: $100k/month ($1.2M/year). Infrastructure is now a core pillar of your operational expenses.

The Mid-Market: $500k/month ($6M/year).

The Large Enterprise: $100M/year. This is the point where infrastructure management becomes a dedicated department.

Here's a Gemini-generated report illustrating various types of expenses.

Credit Card Strategies For AWS Expenses

American Express Amazon Business Prime

Pros: Business card (no impact on personal credit), 5% back on AWS.

Cons: Capped at $120,000 spend/year. After that, it drops to 1%. No transfer partners.

Chase Prime Visa

Pros: Unlimited 5% back. No spend cap.

Cons: Personal card; it will spike your utilization and likely negatively affect your personal credit.

Capital One Venture X

Pros: Unlimited 2X miles on everything. High-value transfer partners.

Cons: High $395 Annual Fee (although offset by $300 travel credit + 10k bonus miles).

I personally value the personal Capital One Venture X more than it's business counterpart because of it's better sign up bonus with a low spending requirement.

However, if you have a high spend, go for the business card.

American Express Blue Business Plus

Pros: 2X Membership Rewards. No Annual Fee.

Cons: Capped at $50,000 spend/year.

Travel Redemptions

To see the real value, let's look at the rewards for every tier where credit card payments are actually feasible.

Using the 2X Miles route allows you to book round-trip Business Class travel via "sweet spot" partners.

North America to Europe (via Flying Blue)

Cost: Roughly 100k miles round-trip for Business Class (Air France/KLM).

Solo Founder: 1 round-trip Business Class ticket to Europe per year.

Series A Team: 4–5 round-trip tickets.

Growth Stage: 24 round-trip tickets.

Mid-Market: 120 round-trip tickets.

North America to East Asia (via ANA)

Cost: Roughly 85k–110k miles round-trip (depending on seasonality).

Solo Founder: 1 round-trip to Tokyo in ANA Business Class.

Series A Team: 5 round-trip tickets.

Growth Stage: 25+ round-trip tickets.

Mid-Market: 120+ round-trip tickets.

Note on Enterprise Spend

While a $100M/year spend is the ultimate goal, it's the point where credit cards are phased out. At this scale, companies move to wire transfers and negotiate Private Pricing Agreements (PPAs) to secure direct 20%+ discounts.

Okay folks, that's all for today. Thank you for your time.

Recommended Cards

Free ConsultationSimilar Posts

April 18, 2025

Triple-Dip Gas Rewards | Maximize Cashback with Upside App & Best Credit Cards

Discover how to save hundreds on gas by combining the Upside app with rewards credit cards and loyalty programs for maximum cashback.

August 6, 2024

How I Stopped Overspending on Credit Cards

Earn rewards without paying interest and late fee.

May 17, 2025

What's In My Wallet Q2'2025?

200K MR points, $400 cashback, 14K Capital One Miles shoping portal bonus and more!

April 10, 2025

BP Earnify + Top Gas Rewards Credit Cards

Discover how to combine BP's Earnify rewards with gas credit cards to save up to 10% on every fill-up at the pump.

March 16, 2025

Best Debit Cards for Digital Nomads

Discover the only two debit cards digital nomads should consider for fee-free ATM withdrawals, zero foreign transaction fees, and instant security features.

December 28, 2025

My 2026 Credit Card Strategy

High reward multipliers, unlimited lounge access, free checked bags and free luxury hotel nights for $85 effective annual fee.