My 2026 Credit Card Strategy

My credit card setup for next year can be broadly broken down into 4 categories.

General Spend Cards - most frequently used cards for day-to-day expenses

Specialty Cards - cards designed specifically for 1-2 purposes

Benefit Cards - cards not used for spend, only benefits, such as, elite status and free bags

Travel Cards - cards used for travel purchases and airport lounge access

In this blog post I will walk you through each of the four categories, explain the rationale behind my core credit card strategy, provide an annual fee and credit breakdown, and tell you my strategies around common transfer partners and transfer bonuses.

Let's get started.

General Spend Cards - Food, Gas, Entertainment, Other

These are points-earning powerhouses with high multipliers on bonus categories that I spend on most often. Instead of getting on card that gives me 2X on everything, I strategically choose 4X category cards for my highest spent categories, then fall back to 3X and eventually 2X.

Here are the 5 cards that will see the most action in 2026.

American Express Gold - 4X Dining, 4X Grocery

Citi Strata Premier - 3X Gas

Capital One Savor Rewards - 3X Entertainment

Capital One Venture X - 2X Everything Else

American Express Blue Business Plus - 2X Everything Else

My 3 highest spend categories every month are: dining out, grocery and "everything else". That's why AMEX Gold, despite it's higher annual fee, is a no-brainer.

I mostly use the Venture X for "everything else", but during periods where I specifically need Membership Rewards points over Capital One Miles, I will switch over to the Blue Business Plus.

Specialty Cards - 6X Citi Nights, Earning Points on Rent

To start off, Bilt card will be my choice for rent payments.

My apartment complex is a Bilt property, so both my rent and utilities are billed through the Bilt portal. Using the Bilt card to earn 1X points on my biggest monthly expense is a no brainer.

The next specialty card is more exciting: Citi Strata Elite.

After much debate I decided to add the card to my setup for one reason only - it earns 6X on Friday and Saturday dinners. Coincidentally, those are the only two nights of the week that we eat out, so it works out perfectly.

To be honest, I mainly got the Citi Strata Elite for the 100K sign-up-bonus, but while I still have it, I plan on taking advantage of the 6X Citi Nights. On my card anniversary, most probably I will downgrade to a Citi Custom Cash.

So, two specialty cards:

Bilt Card - Rent payments

Citi Strata Elite - 6X Citi Nights (Friday and Saturday dinners)

Benefit Cards - Elite Status, Room Upgrades, Free Bags

Looking back at my travels over the last 3 years, there are a few prominent airlines and hotels, no matter where I go.

Hilton Hotels (especially DoubleTree, Curio Collection, Home2Suites)

IHG Hotels (especially Crowne Plaza, InterContinental, Indigo, Holiday Inn Express)

Delta Airlines

Turkish Airlines

Qatar Airways

I realized that apart from Turkish Airlines and Qatar Airways, I could hold credit cards to make my travels significantly better. Let's start with hotels.

So, here are my benefit cards. In other words, cards that I hold for mostly benefits, not earning points.

American Express Hilton Surpass (Gold elite status, room upgrades, breakfast credit)

Chase IHG Premier One Rewards (Platinum elite status, room upgrades, Free Night Certificate)

American Express Delta Gold ($100 hotel credit, free checked bags, priority boarding)

This is a great combination of benefits for very little annual fee. More on annual fees and credits later.

Travel Cards - Lounge Access, Travel Multipliers

I don't fly enough every year to care much about US domestic lounges. If I did, I would have preferred cards that gave me access to Centurion Lounges or Delta Sky Clubs (especially living in Atlanta!).

However, I do fly internationally through Istanbul, Dhaka, and Doha quite often. So priority pass lounge access with a free guest is a must.

Enter my lounge card: Citi Strata Elite.

At least for now, I will enjoy Citi Strata Elite's Priority Pass that comes with one free guest. When I cancel the card after one year, Capital One Venture X will become my lounge card.

Next up: travel multipliers.

Let's further break down travel multipliers:

Flights booked directly with airlines: American Express Gold

Hotels booked direct: Hilton or IHG cards. For other brands where I don't care about elite benefits, I book through credit card travel portals

Credit Card travel portals: Citi Strata Elite

So, to break down how I utilize travel multipliers from my different travel cards.

Citi Strata Elite - 12X flights and hotels booked through portal

Citi Strata Premier - 3X hotels directly booked

American Express Hilton Surpass - 30X on Hilton stays

Chase IHG Premier One Rewards - 26X on IHG stays

American Express Gold - 3X flights directly booked with airlines

3 Ecosystems - American Express, Citi, Capital One

When it comes to transferable points, I am split between 3 ecosystems:

American Express

Citi

Capital One

Yes, ideally I would want to limit myself to at most 2 points currencies. However, I won't be able to maximize points earning that way.

That's where transfer partners come in.

I strategically choose transfer partners that are common across the different ecosystems. That means, whether I earn 4X MR points on Dining / Groceries, 3X Capital One Miles on Entertainment or 3X Citi ThankYou points on Gas, all of them can transfer to the same set of transfer partners.

By pooling points from different credit card ecosystems into one common transfer partner, I maximize points earning, while minimizing point silos (small amount of point dispersed between multiple accounts).

So, what are these transfer partners?

British / Qatar / Iberia Avios (OneWorld flights)

Avianca LifeMiles (Star Alliance flights)

Air France / KLM Flying Blue (Sky Team flights)

All three credit card ecosystems transfer to these partners.

If I have 50K MR points, 25K Capital One miles and 25K Citi ThankYou points, I can transfer all to Qatar Avios. Hence, I will end up with 100K Qatar Avios.

Transfer Bonuses - 40% Citi ThankYou to Qatar Avios

It gets better.

From time to time, credit card issuers give transfer bonuses. For example:

30% when transferring MR points to British Avios

20% when transferring Capital One miles to Qatar Avios

40% when transferring Citi ThankYou points to Qatar Avios

Using the same example above:

50K MR points = 65K British Avios

25K Capital One miles = 30K Qatar Avios

25K Citi ThankYou points = 35K Qatar Avios

Pooling Avios together, I end up with 130K Qatar Avios (30% more by taking advantage of bonuses across card issuers)

2026 Credit Card Wallet Setup

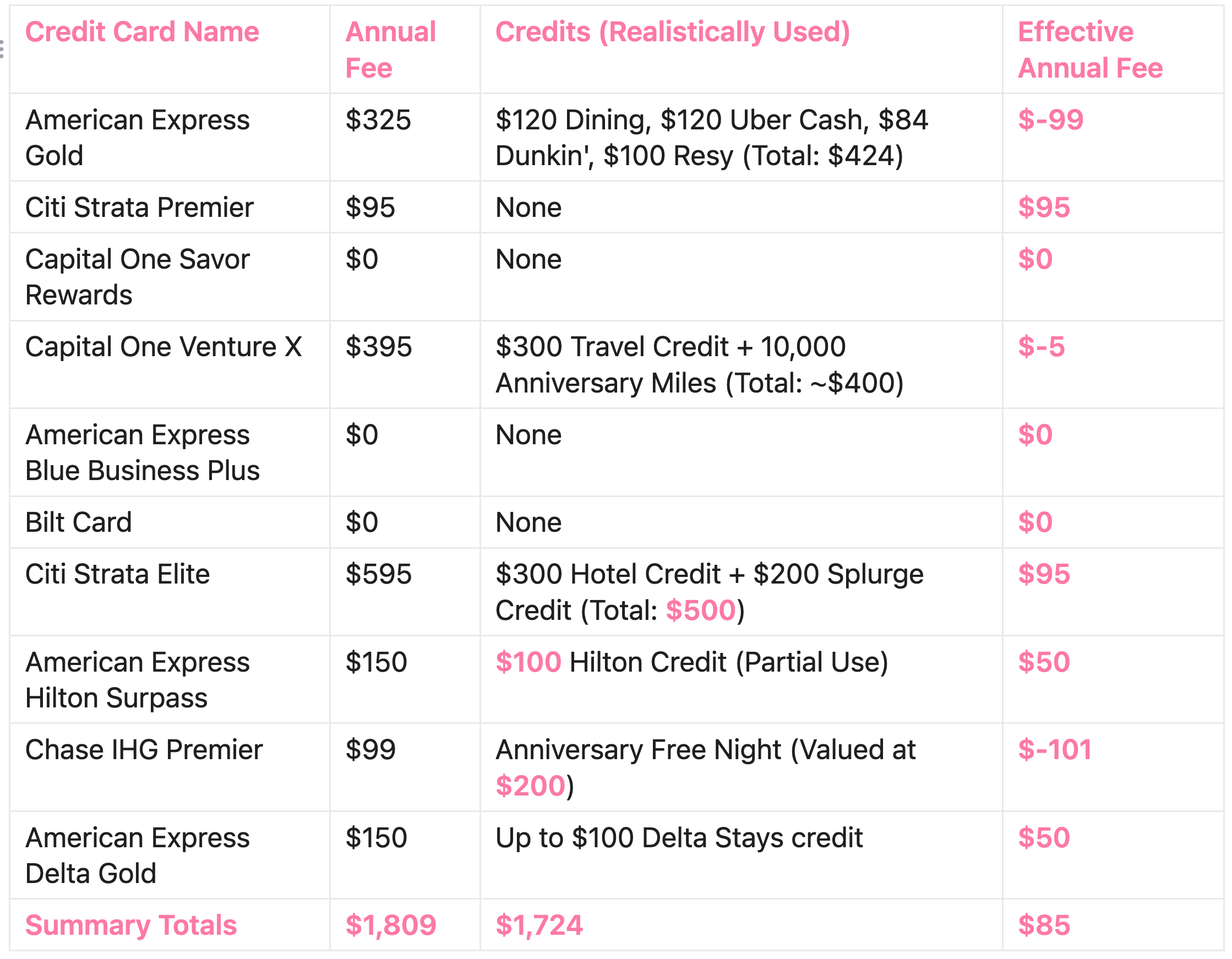

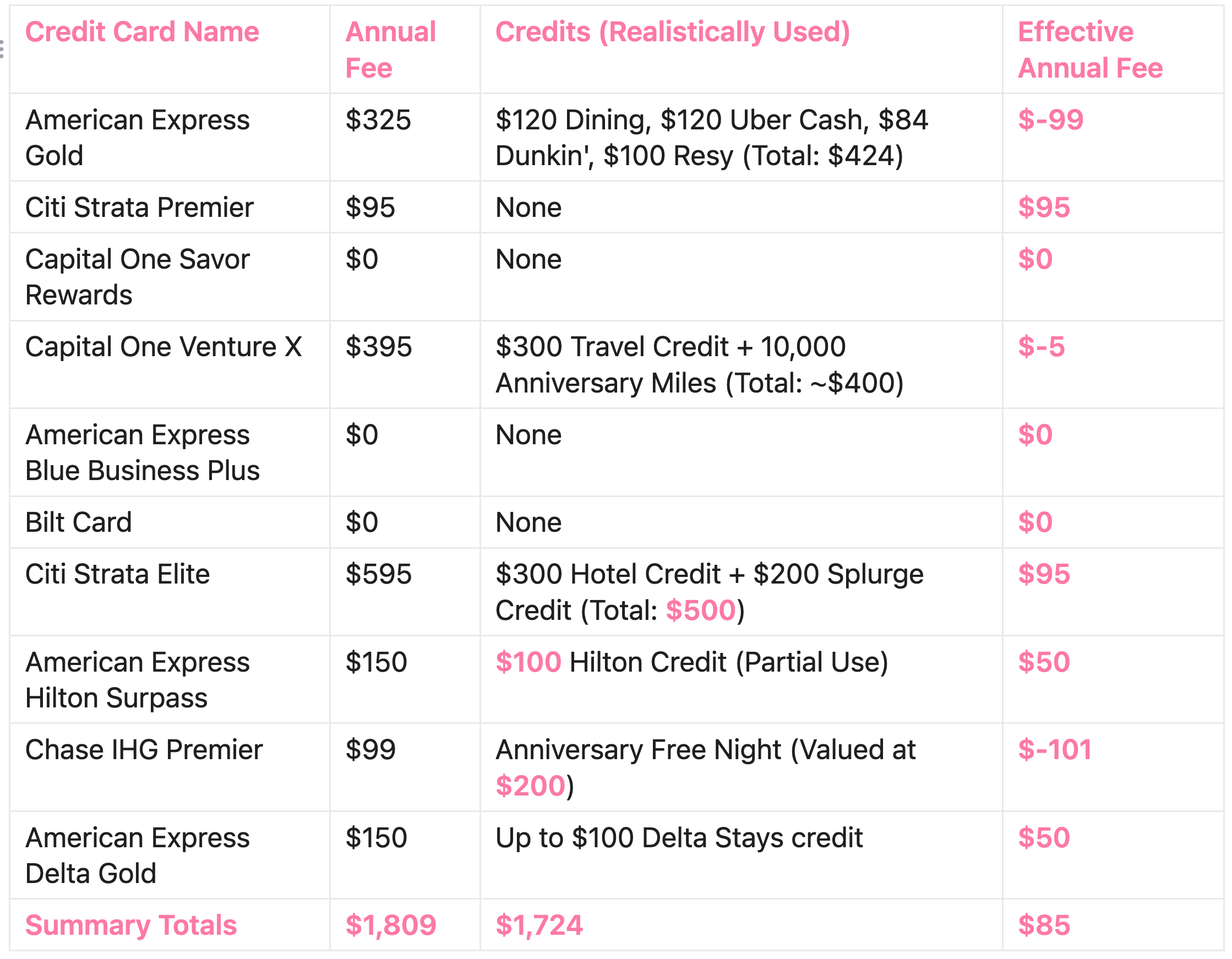

Here's a summary of my overall card setup, with both annual fees and credits that I can realistically use.

Closing Thoughts

All in all, for an effective annual fee of $85, I guarantee myself 4X or 3X on most everyday categories, up to 12X on travel categories, at least 2X on all other categories, lounge access internationally, room upgrades during hotel stays, breakfast or food credits, free checked bags, priority boarding, and so much more!

I look at this as a $85/year subscription for travel rewards and perks.

Recommended Cards

Free ConsultationSimilar Posts

April 18, 2025

Triple-Dip Gas Rewards | Maximize Cashback with Upside App & Best Credit Cards

Discover how to save hundreds on gas by combining the Upside app with rewards credit cards and loyalty programs for maximum cashback.

December 10, 2023

Travel Hacking San Francisco

How I paid $0 instead of $2,543 with credit card points.

December 28, 2025

My 2026 Credit Card Strategy

High reward multipliers, unlimited lounge access, free checked bags and free luxury hotel nights for $85 effective annual fee.

June 12, 2023

How I Travel the World for Free Using Credit Card Points

A simple 3-step process that earned me trips to Chicago, Boston, Atlanta, Dallas, San Francisco, and Toronto for free!

April 10, 2025

BP Earnify + Top Gas Rewards Credit Cards

Discover how to combine BP's Earnify rewards with gas credit cards to save up to 10% on every fill-up at the pump.

August 4, 2024

Half Year Spending Check-in 2024

A deep dive into where I spent my money so far this year.

January 4, 2024

My 2024 Credit Card Strategy

Core setup, new cards, travel redemptions, and hotel, flight, and car rental elite statuses.